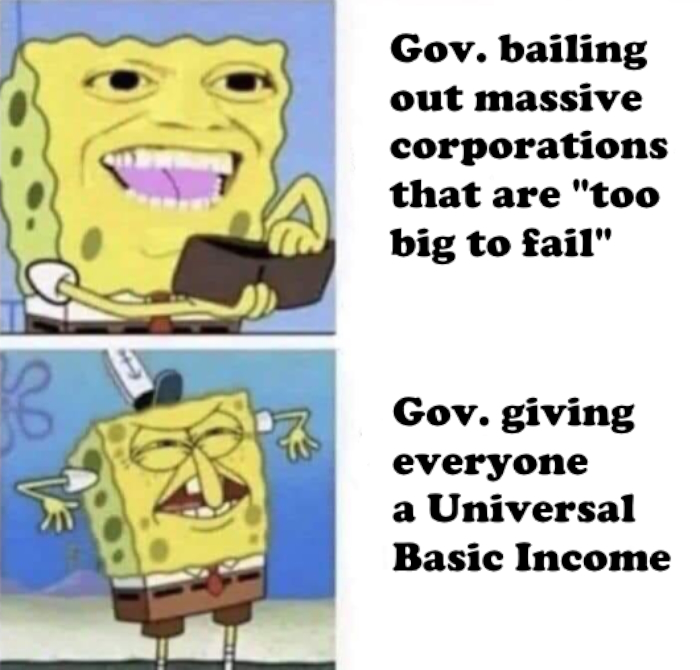

If a company is "too big to fail" the punishment should be that the government bails them out, then breaks it up into smaller parts that are free to fail or succeed naturally without government intervention

memes

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to !politicalmemes@lemmy.world

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- !tenforward@lemmy.world : Star Trek memes, chat and shitposts

- !lemmyshitpost@lemmy.world : Lemmy Shitposts, anything and everything goes.

- !linuxmemes@lemmy.world : Linux themed memes

- !comicstrips@lemmy.world : for those who love comic stories.

Just nationalize them. If the government has to bail them out then then the government just bought them. If a company is too big to fail then it's too big to be privately owned.

That's what they did in my country when a bunch of the big banks almost keeled over in 2008/2009. They were temporarily (partly) owned by the state and eventually bought back their rights to operate as a separate business when things were going better again.

That's actually what the US government did with at least one of our failed companies as well, General Motors.

Should've done it to all the banks and house loan companies too imo.

They also gave GM a 45 billion dollar stock swap and GM never paid it back. They paid back the loan but not the stock swap. Every time I hear people brag about how the government saved GM I wonder what amazing things any company could do with not only 45 billion to play with but the government ensuring that no one could take them down for a year.

Give me 45 billion and the full faith and credit of uncle sam, I will create so many jobs.

Nationalize them and turn the former business into a 501:c3. Also fire the entire C-Suite, with cause to prevent any golden parachute payments.

But I was told that the rich leaders take risks!

…right?

Sure they do. With your pension they are bold.

That's not something that really works with industries that are zero sum games. You can't have a dozen competing rail companies in a given state because there is only so many paths that a rail system can take, and you need to clear out continuous stretches of land through eminent domain.

If a company provides a vital services and fails, it should be nationalized. If a company does not provide a vital service and fails, it shouldbe allowed to fail and the employees themselves bailed out.

Maybe the government should give the money to the employees and if they feel that the company can make a come back they can invest the money in it. If not they can use the money to move on.

That seems fair. If the powers that be where I work for offered me to invest in the comoany itself I would do that. I bet I would get a better return over an index fund the way business is going. Of course they would find some way to fuck it up and corrupt it.

Not much of a "punishment" to the business to have socialized losses. Oh you've mismanaged your ginormous business and it's going to cause a huge, negative ripple effect on the economy and impact everyone else? Here's some free money, courtesy of working class taxpayers! Also we're going to break you up and place no restrictions on how big you can get so that one of your smaller entities can inevitably get enough market share to be in a position to do the same thing a decade later! Huh? Punishment? Oh... Uh... Don't do that again please, Mr. Business, sir 🥺

Hard to effectively punish entities that feel no pain and are otherwise basically immortal

Best we can really do is mow the grass periodically (which the US gov has been failing to do for a LONG time now, although we're starting to see anti-trust rumblings in the tech industry now thankfully)

That's what usually happens in Europe. Companies get bailed and either restructured or nationalised. But muh fridoomz!

Hell, it doesn’t even have to be UBI, just some assistance during Covid would’ve been nice. That one random $1500 check was treated like it was a king’s random and it was probably less than one month’s rent for alot of people.

True in the U.S. Except, of course, in Alaska. Somehow in Alaska, very red state Alaska, home to Sarah Palin, every state resident gets a dividend from the oil revenue. Not that I approve of the reason why considering no one should be making revenue by fossil fuels, but somehow Republicans are fine with that exception. I wish they were pressed on it occasionally.

Conservatives love telling people that winning or losing is a personal failure, and hate government interference, but also love to make life as easy as possible for large corps.

They clearly understand that regulation works, and that governments working to stabilize a country can be really powerful, and then they go and do entirely the wrong shit about while swearing that regulation is evil and governments are evil. It’s all just feelings and whatever they hear first/whatever is oversimplified and yelled.

They're fine with it because voters would hate to have their free money taken away

Oh, but isn't it an 'entitlement?'

That's the point. It's entitlement when poor people do it. It's "the fair share that they deserve" when they do it. If conservatives didn't have double standards they wouldn't have standards at all.

I wonder, do the indigenous peoples of Alaska get that?

I believe they do, but I'm not 100% sure.

To be fair, government bailouts are not just free money the government gives large corporations with no attached expectations. When the government bailed out GM, for example, the treasury gave GM $52 billion. $6.7 billion was considered a loan (with interest) which GM has since paid back. The rest was an investment resulting in a 32% ownership of GM by the US Treasury.

There's also a shit tonne of people and other businesses that rely on a company like GM.

It would be terrible for everyone involved, not just the economy but also for quality of life. Bailouts are bad, but not bailing out is worse. So what do we do? (Sorta) simple, legislation the prevents the amount of risks that banks are allowed to take. My proof is by counter example. The great financial crisis of 2008 was due to deregulation, mainly pushed by Regan era policy. Limits on banks force them to take their due diligence with each loan and decreases the risks of bubbles (crypto, housing, coins, etc.) forming in the first place.

With obesity being a big problem, we could always frame UBI as being for individuals too big to fail as well.

I'm ignorant, and maybe I shouldn't ask this in a meme community, but wouldn't a UBI become the new $0?

Like all the corporations now know we get x-amount more so now prices are adjusted to take a portion of that across all sectors, and now I'm back to not being about to afford the same things as before? Idk I don't have an econ degree.

Not really. It's not magical money that just appears.

It's redistributed money.

Things may increase in price, not because of greed, but because supply and demand jumped dramatically. Think of all the people who now have money to buy random things like treats or toys.

That's not a bad thing! Suddenly, companies need to hire more people to increase supply, because people have resources to spend.

Expensive stuff still exists. No matter what. But the bare minimum quality of life increases dramatically.

No because taxation would be adjusted so the average person is no better off.

It's about raising the lowest earners to a minimum level that they're able to live on, without making them jump through hoops or prove they are poor or prove they have been looking for work for 40 hours a week or some bullshit.

The way I think about it is by creating a scenario. We give 100% of people $1000 dollars (just for sake of argument). Some people use this for groceries, others for car payments, others for investments. Some people don't even realize they got that money bc they were so rich. Some people can afford to pay for school supplies for kids. They key point is not everyone is using it for the same thing.

The reason it sounds like it should become the new zero is bc it does happen in some situations. If the government gave everyone that rents $100, then landlords will raise rent by $100 a month later. The main difference between the two is how specific the scope of the money is.

Yes, there would be economic changes (not necessarily downsides) such as higher inflation due to government spending, but also increased GDP which will stimulate the economy drastically. It will lead to higher unemployment, not bc people stop needing to work, but bc they can quit their second job or focus on taking care of kids full time (which that actually doesn't change unemployment, but it would change the workforce numbers).

I am not an economics major or anything, but I tried to give reasons to explain why we would expect these changes to happen in the real world.

Those corporations would still be competing with each other to be the one we spend that $ at though.

Disclosure: I don’t have an econ degree either

I don’t think that mechanism you’re referring to automatically finds its new equilibrium right back where you started.

Let’s take rent for instance. All the current renters in lowest income bracket now have $1000/mo more to spend.

Next income bracket up now has $800 more to spend. Not because the UBI is varying, but because the tax people are paying into the UBI is varying. So this next bracket up is putting $200 into it as taxes and getting their $1000 check. At a certain point, there are the people who break even. And above that, people are paying more into the system than they’re getting back. That’s worth mentioning.

But focusing on this lowest income bracket as if it’s a little segmented, separate economy. Like a slice, to analyze it.

Town with 100 people. Let’s say there’s 105 units of housing, making for a teeny bit of pressure on landlords via competition. The landlords live elsewhere; ultra simple model here. Each of the 100 people gets $1000 more to spend. Fuck it, all they’re spending it on is rent. It’s the only thing they have to buy.

Well, there’s still competition between the landlords. If a landlord’s got an empty unit, he can offer it for $200 less than the other guy and get a tenant in there. Excess supply is good for consumer negotiating power.

But also, let’s say all units just go up by $1000/mo, and swallow up the UBI.

Then other developers now have a new equation in terms of the costs and benefits of building new housing.

Maybe now that you can charge $1500 for an apartment instead of $500, it’s worth it to build a new apartment building. It’s become more profitable.

So someone builds a new apartment building, and there’s 120 housing units for those 100 renters. Now you’ve got 20 desperate landlords (or one landlord with 20 un-rented units) willing to take say $1000 instead of $1500.

That pushes the price of rent back down.

Of course it doesn’t actually sway wildly like this. Every player thinks ahead about all the moves that can be made.

Like if your apartment building is profitable at $1500 but not at $500, what’s the cutoff? Maybe if rents drop below $1200 your new apartment building is going to lose money.

There’s some equilibrium point, and that’s what the market price settles into, as people finding themselves far from that point find it profitable to move toward it. (You make more money renting out five units at $1000 than you make renting out two units at $1500 - lowering the price is profitable here).

So now to crack this model open again, what is this “other place” where these landlords are coming from to invest new money in housing?

That’s where we bring in the higher income tiers, the ones who pay more into UBI than they receive out. The money is coming from up there. In those places, the people have less money than they did before, and so it is becoming less profitable to fulfill their needs. Maybe the amount you can get for a luxury apartment in manhattan drops from $50k to $49k per month.

Ultimately, resources used to fulfill demands, get slowly and steadily re-allocated to serve money’s new center of gravity, which is slightly lower than before.

Prices go up for poor people goods, but not enough to eat all the income. And the new amount of money flowing improves the offering, even at the same price levels, by bringing more investment overall into those industries.

Getting money from the government is like the one thing that's classy to do if rich, but considered tacky if poor.

Yeah there's that, then there's this:

There is also a lobbying effort behind it. We can't ignore that economists continue to argue for bank bailouts and against welfare programs.