Paul – per your request, I emailed you questions to your corporate account. These questions are from http://WhyDRS.org and various investor communities online. I believe Kevin will be sending you additional questions based on his specific concerns.

Thanks to everyone who submitted public questions, and to those who helped gather and organize them. For public review, here is what we sent Paul Conn, President, Computershare Global Capital Markets:

Paul,

Thank you for the opportunity to send general DRS questions. We wanted to send along this list of questions and reopen communication. Much of it is similar to the list of questions sent last year, but we've since answered some and come up with plenty of new ones. It was very nice to see you meeting criticism and concerns from some community members head on over the last week, and that's part of why we're reaching out now. We believe that investors choose to levy such accusations and air out their theories because they are passionate about ownership and want to know the truth. These theories can come from a lack of understanding and a drought of good information with strong citation. Hope we can connect and earnestly tackle this situation, and help everyone get to a more learned place. To start, here’s some context as to why investors are so concerned and curious.

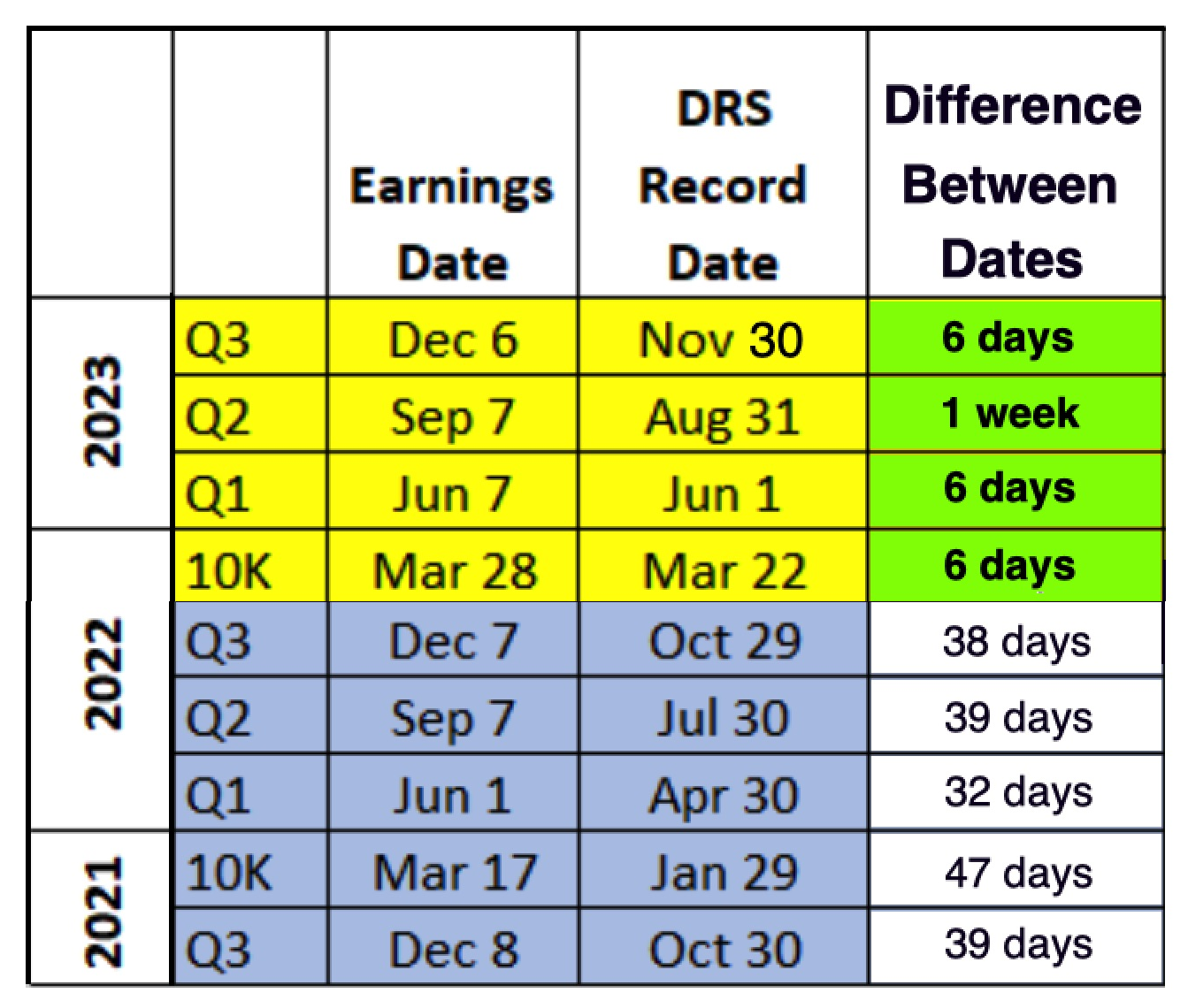

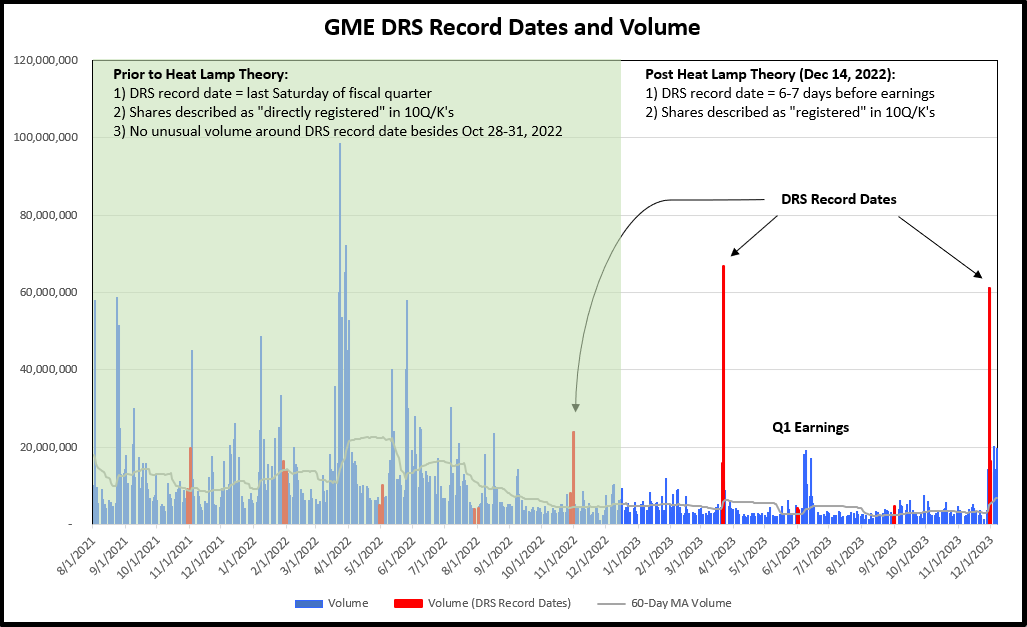

We understand that you cannot answer specific questions on individual stocks, but we think it would be helpful to provide you (and others) a little context as to why investors are so concerned and curious before we list the questions. Approximately 25% of GameStop Corp.’s ($GME) outstanding shares have been registered with their transfer agent (Computershare) for over a year now. While it's possible that there is an innocent macroeconomic explanation for this consistently reported number, GameStop investors and all investors who are driven by a desire to own their investment via DRS want to know more about alternative explanations. Investors have noted anomalous trading volume, particularly on or around the dates for which GameStop reports registered shares (DRS and DirectStock plan shares). Most of $GME’s outstanding shares are accounted for by mutual funds, ETF’s, other funds, insiders, and DRS and plan shares, so it’s odd when 20-25% of the outstanding shares trade in a single day (or a couple days). It’s even more curious when the volume spikes near the DRS record dates.

It’s possible these large spikes in volume are related to illegal options trading used to avoid complying with close-out requirements under RegSHO (see August 9, 2013 SEC Risk Alert https://sec.gov/about/offices/ocie/options-trading-risk-alert.pdf). While this is outside the purview of Computershare, there are concerns that a portion of the $GME shares held by Computershare, Computershare subsidiaries, nominees, etc. may be associated with these options trades via lending or as locates. It's with this context in mind that we'd appreciate your weighing in once again and providing some of your thoughts regarding not GME specifically but the ownership nuances within the current system.

You and other industry experts and veterans have provided many hours of your time to altruistically try and meet the needs of a newly emergent base of activated and curious retail investors. However, there is an ongoing confusion and request for clarity and to that end we've prepared an index of terms/definitions in order to confirm we're using industry terms with shared understanding and then several more in depth questions that speak to remaining uncertainties DRS enthusiasts have. Please refer to the Appendix for these terms. We would like to be deliberate about the terms used. Any industry terms should be individually defined in context and in the view of the person using the term.

We’ve gathered questions from several online investor communities. A dialog back and forth discussing the questions and making sure all questions and answers are thorough, in order to address the speculation and concerns of retail investors would be ideal. Considering the recent / ongoing theories and allegations regarding the degree to which Computershare has lagged on providing clarifying information in the investor communities. Answering these questions will put many investors as well as their speculation at ease and show that Computershare is committed to maintaining transparency and investor trust.

Key Questions: Ownership Structure

-

Some investors have started using the term ‘Sole Legal Title’ to refer to an investor who owns shares in their own name exclusively, on the issuer ledger, without any other entities involved (no nominees, no custodians, etc). ‘Pure DRS’ holdings would represent ‘Sole Legal Title’ while owning shares through a Plan or in an IRA with a custodian would not. Is there a better /more official term for this kind of ownership? An SEC bulletin uses the phrase ‘DRS Form’.

-

Who is the named owner on the share ledger for shares held at the DTC for Operational Efficiency? Is it Computershare’s nominee, DTC’s nominee, or someone else? It is understood that the investor will still be listed by name in a subclass.

-

Can you explain in detail exactly how the holding works for Plan shares held at the DTC? Are those shares considered "non-investor owned"? If so, what does that mean exactly? Are non-investor shares mutually exclusive with other holding types? What are the actual account types that CS uses to interface with the DTCC with for DRS purposes?

-

Which of the following descriptions would you say best describes Plan shares held with DTC for operational efficiency purposes: “held by Cede & Co on behalf of the Depository Trust & Clearing Corporation” OR “held by registered holders with the transfer agent”

-

Please clearly describe the location and settlement process for a market order for shares in the DirectStock plan vs a company sponsored DSP (such as DepotDirect). What is different about how these shares, once settled, are recorded on the issuer’s ledger?

-

Can you describe the possible chains of custody and ownership for shares in various holding types including Pure DRS and DirectStock such as: custodians, omnibus bulk owners, nominees, Computershare subsidiaries, including what account types are used to manage each. In addition, could you describe the way names appear on the ledger in each of these cases? Ex: “Pure DRS”, plan holdings only, mix of both, shares held in subclass, beneficial ownership outside of DTC, etc.

-

Currently, the common understanding is that Dingo & Co is a nominee used by Computershare for investors in DirectStock to enable features such as fractional shares and fungible bulk holdings. Individual investors names are listed as a subclass, which are on the issuer ledger under the name Dingo & Co. This is a form of beneficial ownership, but is not street name ownership, as shares purchased or through plan are removed from the DTC. Is this an accurate description of ownership structure?

-

Does Computershare or its subsidiaries have more than one nominee which holds shares?

-

In June 2023, the SEC’s OIEA and FINRA released bulletins (excerpts below) certifying that investors who purchased through plan and wished to hold shares directly on the issuer ledger needed to transfer those shares from plan to DRS. The CS FAQ uses similar language. Both Plan and DRS investors appear named on the issuer ledger. Could you describe the process of the Plan -> DRS transfer described here, and how the ownership record changes as a result?

-

“According to FINRA, the SEC, and Computershare: Purchases made through the issuer (or its transfer agent) of securities you intend to hold in direct registration are usually executed under the guidelines of the issuer’s stock purchase plan. You’ll need to instruct the transfer agent to move the securities to the DRS.” https://finra.org/investors/insights/know-the-facts-direct-registered-shares “Purchases made through the issuer (or its transfer agent) of securities you intend to hold in DRS are usually executed under the guidelines of an issuer’s stock purchase plan, which uses a broker-dealer to execute the orders. Thus, to hold in DRS once the securities are acquired, you would need to instruct the transfer agent to move the securities from the issuer plan to DRS.”

https://sec.gov/about/reports-publications/investor-publications/holding-your-securities-get-the-facts “Purchases made through the issuer (or its transfer agent) of securities you intend to hold in direct registration are usually executed under the guidelines of the issuer’s stock purchase plan. You’ll need to instruct the transfer agent to move the securities to the DRS.” https://computershare.com/us/becoming-a-registered-shareholder-in-us-listed-companies

-

With DirectStock enabled, a user enters a principal-agency relationship with Computershare. Can you explain the principal-agency relationship Computershare has with an account holder? https://cda.computershare.com/Content/7bfc0b25-4836-40a4-918c-9a86d658d798

-

When Shares are transferred from a brokerage to a Computershare account, only whole shares can be transferred and documents from computershare say “DTC Stock Withdrawals (DRS)”. Are shares purchased through DRP/DSPP also “DTC Stock Withdrawals (DRS)”, but withdrawn to Computershare’s nominee rather than the investor?

-

If the reported DRS totals for an issuer for the last 5 quarters straight are consistent (within rounding of ~100k shares), what are some possible explanations for why this might be?

-

Is it possible any quantity of registered shares are not being counted in the total reported to the company for any reason? (plan designated, DRS shares, fractionals, "operational efficiency", etc) Per CS FAQ, issuers are provided Plan and Book holdings tallies separately.

-

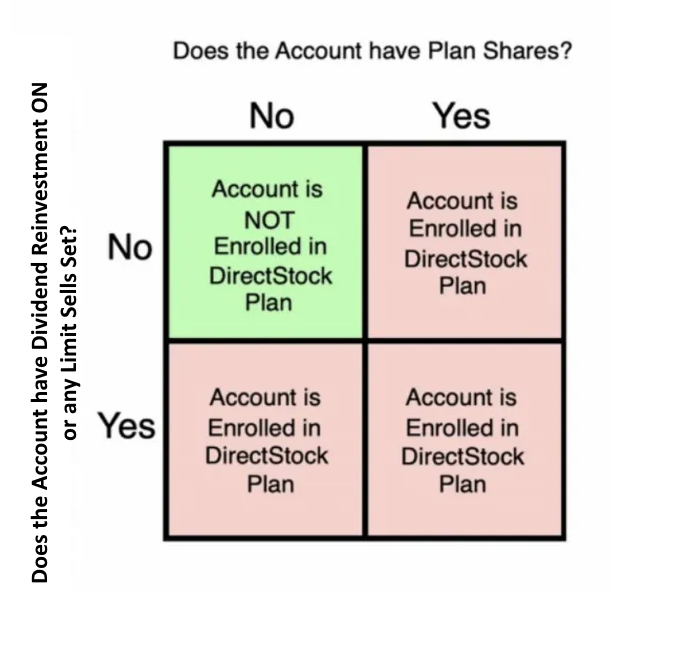

If an investor has a Computershare Investor Center account that's holding shares of designation "Book", does enrolling that account in the DirectStock Plan have any effect on who holds title to those shares? Specifically, do they remain DRS (DRS Form/Pure DRS), or do those shares become held in the Plan? Does it matter the method by which the account is enrolled (such as: plan purchase, DRIP activation, or setting a limit sell order)?

-

If an investor is enrolled in the DirectStock plan, are all the shares (DRS and plan) in their account considered plan-enrolled shares per the Computershare FAQ?

-

Some of Computershare’s online customer service representatives have stated that Dingo & Co was nominee for plan shares for multiple companies, but Dingo & Co has only been found listed in a small number of filings such as proxy for MGE Energy or bankruptcy filings for SOUTHERN FOODS GROUP, LLC. How do investors find more information on Dingo & Co and their function?

Operational Efficiency (OE)

-

Is Computershare (or their subsidiary, nominee, or chosen broker dealer) compensated by the DTC, the Issuer, or any other third party for maintaining operational efficiency?

-

In the May 2, 2023 update video you appeared in, you said “typically we would hold somewhere between 10 and 20 percent of the shares that underpin the plan through our broker at DTC” and that “we need to maintain a small portion of the inventory at DTC so that we can have effective settlement.” Can you define ‘underpin’ and ‘the plan’? Is the "whole" all shares of a given security owned by accounts enrolled in the DirectStock plan?

-

How could an investor of a given security learn the exact number of shares kept with DTC for OE% by Computershare on a given date?

-

Are shares of any given security owned by accounts enrolled in the DirectStock plan maintained in fungible bulk and held by Computershare’s nominee?

-

Near the end of the 5/2/23 YouTube video “An update on Fractional and Plan Shares”, you said there was a "mischaracterization" of the problem online. What did you mean?

-

Computershare states on the FAQ that they determine the portion used for OE - how is that ratio determined, and how often is it recalculated? Is it a function of a market condition such as volume, price, or something else? Is there a way for investors to track how many shares are allotted for OE?

-

Are the claims made on Shareholder Service Solutions about DirectStock on this page correct, specifically regarding the cost to issuers who are interested in DirectStock? https://shareholderservicesolutions.com/news-item/online-only-direct-stock-purchase-plans-from-computershare/

-

You have stated in the past that DTCC typically holds 10%-20% of plan shares for operational efficiency. What about in atypical situations - How often and how far does OE% stray from the 10-20% range? Has any individual equity risen above that mentioned threshold, and what’s the highest percentage that an equity has ever experienced?

-

Does operational efficiency negatively impact the continuous holder requirement, as required for items like shareholder appraisal rights?

-

Are DRS designated shares pulled into the plan when DRP/DSPP (DirectStock) is enabled, or are only Plan designated shares affected by enrollment?

Reporting

-

Does Computershare directly provide issuers with a total account of issued shares, broken down by record holder, totaling up to shares outstanding? Is this data available to the issuer in real time through the Issuer Online portal?

-

Under what circumstances (if any) would DRS shares held with Computershare for which Cede & Co is not the registered holder be held at the DTC?

-

Under what circumstances (if any) would Plan shares held with Computershare for which Cede & Co is not the registered holder be held at the DTC?

-

Can you confirm if there are currently any ongoing corrections or dispute resolutions involving Direct Registration transactions, specifically using the '396 (Direct Registration Reclaim DK-Without Memo Seg)' code, that have impacted reportable DRS numbers in any stock significantly?

-

Could you provide details on how the application of the '396' transaction code for Direct Registration Reclaim DK-Without Memo Seg activities is being monitored to ensure the integrity of DRS numbers?

-

What procedures are in place to review and approve transactions under the '396 (Direct Registration Reclaim DK-Without Memo Seg)' code, and how are these documented in the context of DRS reporting?

-

Has computershare seen any significant volume increase in Delivery Orders marked with codes 391 or 396 around significant DRS reporting dates for any of its issuers?

-

Could you speculate as to why an issuer might choose to adjust the language in their 10Q/K of the way they report DRS totals, or what a change in language could imply? For example, if an issuer reported DRS shares as “directly registered” for almost two years and then changed the language to “registered” alone.

FRACTIONAL SHARES

-

Is it possible to be the sole legal title holder of a fractional share, meaning no other entities other than the investor are involved in the ownership of that fractional share?

-

Are fractional shares entitled to cast votes? Is this issuer dependent?

OTHER

-

Why does the issuer name come up on bank statements when purchasing through DirectStock?

-

Multiple French companies provide various benefits to “pure registered” shareholders, for example L’Oreal awarding an increased dividend payment. Does Computershare offer U.S. issuers the option to provide benefits like this? Does Computershare offer these benefits in other countries?

-

Computershare has indicated in the FAQ that it is up to individual issuers to disclose shares in DSPP in their tally of directly registered shares, and that such a disclosure may be subject to legislation and regulation. Could you direct us to the relevant legislation and regulation?

-

Between Feb 24 and March 20 of 2023 there was a change made to CS FAQ involving the maximum limit sell order amount reduction in 2022, citing the risk cap of the broker. The limit was changed again around Feb 22 of 2023 to 7x the price of the security. Why was this language removed from the FAQ? It would seem plausible to remove that if 7x the current security price is within the brokers tolerance, but it also had specifically mentioned that this change was made because of 2 specific securities who had >7x their price in 2021 from 2020.

-

Does Computershare have any input as to the language used in financial disclosures for DRS ownership (GME / AMC) or do they provide the holdings data alone?

-

Computershare organizes recurring purchases for hundreds of stocks through various Plans, and specifically with DirectStock Computershare operates a predictable recurring market buy. Does Computershare profit (through PFOF or otherwise) through the provision of this market data and activity to its broker partners?

-

Do you feel that a recurring and predictable schedule for recurring buys creates an issue for recurring buyers? Predictable price movement can lead to arbitrage opportunities and can result in worse outcomes for plan participants in terms of dollars invested/shares owned.

-

Who, besides DTCC, can see ownership records of DTC members at the DTCC?

-

When participants log into the FAST system at the DTCC for DRS functionality, can they see anything about shares that the DTCC holds? The user manual for the FAST system has a DRS section but it is only a couple of pages with some screenshots, not granular data.

-

What are the effects of a “Chill” on DRS transactions?

-

What is Computershare’s regulatory requirement in reporting possible crime if you notice problems or discrepancies?

-

What are the effects of a Stop Trade designation on an account that holds either only Plan, only DRS, or both Plan and DRS shares?

-

Several investors with multiple Computershare logins have reported that placing a stop trade restriction on a single account is blocking their ability to login to all accounts. Should this be happening and if not, how can they get this resolved?

-

Certificated shares may be enrolled into "DirectStock plan", but they are labeled "not available". Can you clarify what "not available" means in that regard?

-

Is there a cost to an issuer for offering Computershare's QuickCert paper certificate service to their investors, by which Investors can pay $25 each to certificate their shares?

-

When a Transfer Agent and the DTCC disagree on the cause of a share discrepancy what is the share reconciliation process? How long do these instances take to resolve, and what is the largest instance of this happening to your knowledge?

Thank you for taking the time to answer these questions. As the largest transfer agent for U.S. markets, we hope to continue this journey of transparency and understanding with you.

Sincerely,

The WhyDRS Team and Various Investor Communities

APPENDIX - Terms Book Entry - All electronically tracked and uncertificated shares are considered book-entry shares. Book Holdings - Shares labeled ‘Book’ on the Computershare Investor Center UI Plan Holdings - Shares labeled ‘Plan’ on the Computershare Investor Center UI Pure DRS - An investor center account with 0 Plan holdings and is not enrolled in DirectStock DirectStock - Proprietary Computershare plan structure. Not sponsored or administered by the issuer. Investors will be listed on the share ledger in a subclass under Computershare’s nominee - this is technically a type of beneficial ownership. Plan - A Plan allows investors to facilitate purchase of shares through the Transfer Agent’s interface. This can involve market purchases or can involve sale directly from the issuer. DSP (Direct Stock Plan) - from what we can find, this is clearly defined by the SECand involves direct purchase from the issuer and special issuance of shares. DSPP (Direct Stock Purchase Plan) - Not clearly defined by the SEC, but DirectStock is described as one and involves recurrent purchase at the market through Computershare broker partner. Chain of Custody - A reflection of ownership rights through different market participants, tracing from legal holder to the ultimate beneficial owner at the other. EX: Investor>Broker>Cede and Co On the Ledger / Registered holder - Registered holders, per CS FAQ, are listed by name on the company register. This would include both ‘Pure DRS’ investors along with ‘Plan’ investors. Legal Title Ownership - An investor has legal claim to the underlying asset, and may share that claim with other entities. Sole Legal Title Ownership - An investor is the only entity with legal claim. Operational Efficiency - The process of keeping a portion of the fungible bulk of plan shares with a broker partner (with DTC) in order to facilitate quicker and more efficient settlement. Underpin - We’d like a better definition for this. You used this word to describe the shares which are involved with the DirectStock Plan. Nominee - Entity in which securities are kept in order to facilitate transactions more smoothly. Custodian - When a firm is holding an investment on behalf of a client for safekeeping Omnibus - The pooling of investments from multiple individuals under an entity such as a nominee. Fungible Bulk - A description of shares kept in an omnibus. Fungible bulk shares are indistinguishable from each other and can be drawn down against the total without impacting the listed holdings of any participant. Dingo & Co - Listed as Computershare’s nominee on an MGE Energy Proxy Filing. Does it also act as Computershare’s nominee for other plan structures? Computershare Trust Co NA - A DTC Member and broker subsidiary of Computershare. Manages the sales facility, and when a limit sell order is placed, shares will be transferred to Plan designation under this section of Computershare. Chill/Freeze : A method of preventing transactions from occurring on specific shares or a CUSIP involved in a corporate action. When shares are chilled, they cannot be moved. This list of terms is not exhaustive, and so if you can think of any terms which are commonly misunderstood or confused, we'd appreciate your adding them.

Word is slow to spread - in part because those of us prepared and interested to spread the word don't always have access to these other legacy platforms! and at the same time, relevant players (such as PP in the BBBY community) chose not to embrace Lemmy as a viable alternative before/during/after the cutdown of their presence on Reddit.

The power of decentralized alternatives is of course that they are a forever alternative and can only grow. Slow but steady.