the_dunk_tank

It's the dunk tank.

This is where you come to post big-brained hot takes by chuds, libs, or even fellow leftists, and tear them to itty-bitty pieces with precision dunkstrikes.

Rule 1: All posts must include links to the subject matter, and no identifying information should be redacted.

Rule 2: If your source is a reactionary website, please use archive.is instead of linking directly.

Rule 3: No sectarianism.

Rule 4: TERF/SWERFs Not Welcome

Rule 5: No ableism of any kind (that includes stuff like libt*rd)

Rule 6: Do not post fellow hexbears.

Rule 7: Do not individually target other instances' admins or moderators.

Rule 8: The subject of a post cannot be low hanging fruit, that is comments/posts made by a private person that have low amount of upvotes/likes/views. Comments/Posts made on other instances that are accessible from hexbear are an exception to this. Posts that do not meet this requirement can be posted to !shitreactionariessay@lemmygrad.ml

Rule 9: if you post ironic rage bait im going to make a personal visit to your house to make sure you never make this mistake again

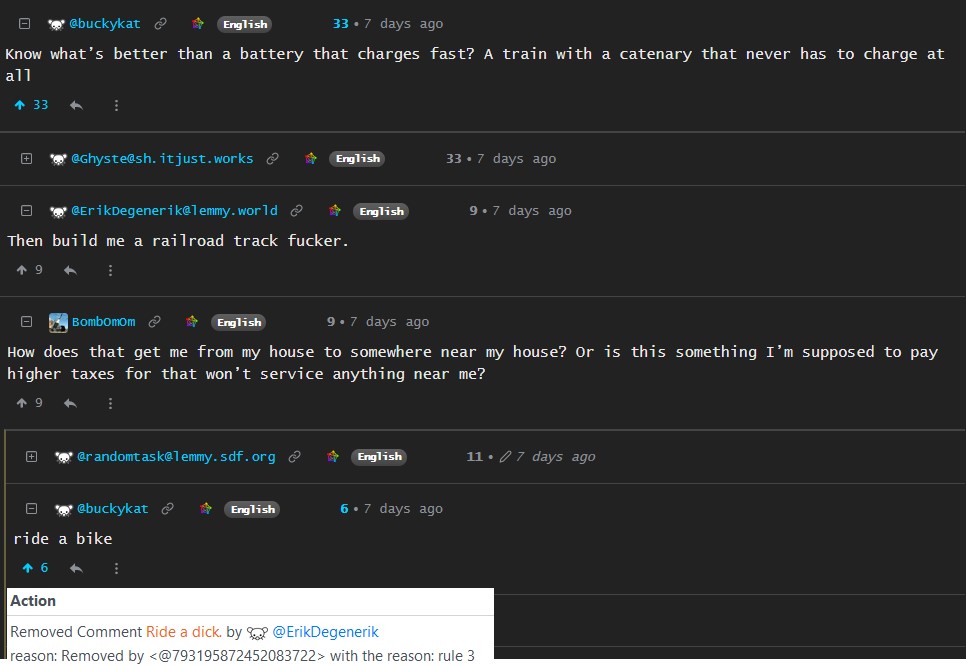

view the rest of the comments

Why do Americans hate paying tax for things that benefit the community so much?

Except that taxes do not fund government spending. This is a neoclassical myth that needs to die.

The US government can literally give free healthcare to everyone and solve homelessness tomorrow without having to tax for anything, or having to “cut spending elsewhere to pay for it”, because the Federal Government can create whatever amount of currency needed to fund its free healthcare project.

Taxes come later to remove the excess liquidity from the circulation. Remember, the Federal Government has to spend the dollar first before they can be taxed back.

ok but public transit in a town is gonna be funded by some grants probably and then operated on rider fees and local taxes. Gary Indiana isn't sovereign and Mississippi can't afford shit.

That’s the point. A country that is not constrained by resources, labor and technology should never have to go through this. There is nothing stopping the Federal Government from handing out generous grants to improve the infrastructure of states/cities/towns.

Taxes serve the purpose of changing behavior (penalty for smoking, for example, or to encourage the adoption of environmentally friendly technology) and reducing wealth inequality (taxing land, rich people, corporations), but these taxes are not used to pay for the good stuff. You don’t tax billionaires to fund government spending, you tax them because you can and you don’t want a small group of people to hold disproportionate amount of wealth.

that failure of the federal government has nothing to do with what i was talking about.

on a local level the local taxes we all pay are directly in the budget for that spending. we literally vote on 0.025% property tax increases to pay for specific local projects.

"taxes do not fund government spending" is literally false for entities that don't control the currency or those resources.

Any tips on where I can learn more about this concept?

Modern Monetary Theory. From an purely economic perspective, SimulatedLiberalism is right.

Think of taxes as an olympic sized swimming pool, a politician may say they are raising taxes to dump a new bucket of water into the pool, but some guy comes around once a month to drain or fill the pool so it always stays level.

Even if what you say is true, telling people tax funds the government/public infrastructure incentives people to pay tax. If you go around telling people "I'm taxing you because I can, and the tax will be used to fund my vacation to Dubai" you're gonna get shit on

to the grasping petit bourgeois, any need fulfilled by the state is a lost profit opportunity

At one point you could say taxation was balanced. People at the top paid more and people at the bottom got services. Almost immediately after WWII, the bourgeois started rolling back on the services. They really hit their stride in the 70s and just started gutting everything. It got worse in the 80s and the in the 90s, Democrats became just as bad as Republicans. In the 80s you also saw taxes being cut for the top despite increased spending on things that benefited the bourgeois. So the tax burden fell upon the lower class. They saw increases in taxes while seeing fewer services than ever. Plus the libertarian propaganda pumped into education didn't help. Privatization is always framed as more efficient and cheaper for the public. So the question becomes why tax me for something I'll never use and if it gets built it'll be shitty and cost too much over time?

I guess, to be more succinct, they don't view it as a benefit to the community. Just a cost to them.

Selfishness that is perceived as a virtue and a strength.