this post was submitted on 22 Sep 2023

1239 points (96.3% liked)

Antiwork

8277 readers

2 users here now

-

We're trying to reduce the numbers of hours a person has to work.

-

We talk about the end of paid work being mandatory for survival.

Partnerships:

- Matrix/Element chatroom

- Discord (channel: #antiwork)

- IRC: #antiwork on IRCNow.org (i.e., connect to ircs://irc.ircnow.org and

/join #antiwork) - Your facebook group link here

- Your x link here

- lemmy.ca/c/antiwork

founded 3 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

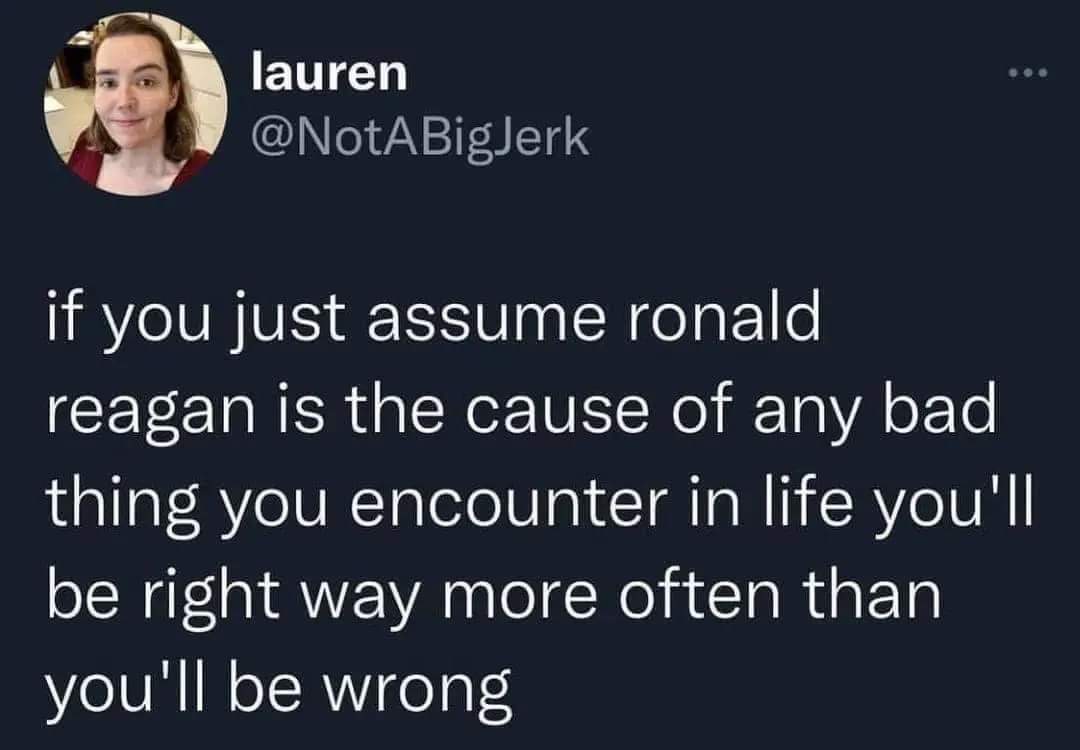

The bailout system we have now, starting in 2008, is way worse than any reaganomics. Now we just hand them cash and don't even expect it to trickle down.

Bitcoin was created in response to this, it's even written in the first Bitcoin block ever minted "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks". The US government printed nearly a trillion dollars to bail out the banks, governments worldwide did the same as the economic crisis unfolded. People lost their jobs, their savings, all of us had our currency devalued by the massive (but necessary) money printing to stave off a total financial collapse. And the CEOs of those failed banks had the audacity to give themselves lavish bonuses with that money. It was a massive wealth redistribution. And not a single one went to prison for it. 99% of us were forced to foot the bill for the reckless actions of a vanishingly small but ridiculously wealthy and powerful portion of the population.

And unfortunately, we have had to do this again and again because of a crucial flaw in modern banking: if banks loan out money, and everybody is all loaning to each other, there will be an economic shock that comes along that causes a bank run. When that happens in an interconnected, global economy, you can't have a big bank fail, because all the other banks will fail too, and the entire financial system will outright collapse, just like it did during the great depression. The guy who realized this is ben bernacki, he won a nobel prize in economics for pointing out that much of the harm from the depression came not from the market panic but from the failure of the banking system and faith in it afterwards. You don't know his name, but you would recognize his face, he is the one that sold the bailouts to congress and the world. But he does not have a solution to this problem aside from bailouts. Constant wealth distribution trickling up to those who are already the most wealthy and powerful in the system.

Satoshi saw this and knew there was a better way, so he created a new currency system in which no one person or organization could ever have the power to just turn on the money printer like that ever again. Because the temptation is just too strong. Every empire or nation that has ever failed ended with a period of hyperinflation caused by the massive increase in the money supply. Both sides in the US civil war did it, Zimbabwe did it, Nazi Germany did it, the USSR did it, Venezuela did it, the Roman Empire did it. Every country that is at war and runs out of money to fund the war does it.We need a system which does not rely on human choices being the difference between a sound money supply and a useless one. That is what Bitcoin is. It has a fixed supply. And the only person who can spend that BTC is the one with the keys: you. And it can be accessed by anybody in any country in any economic situation so long as they have a computer or phone and internet access.

Edit: Got Bernacki's name wrong

Unfortunately, since apolitical money is not meaningful as a concept, any viable solution to ineffectual political processes must entail repairing if not reconstituting such processes within the political frame.

Gold was apolitical money for a long time. Can't just print gold.

Gold has use value. It is and has been traded for its use value, which is the same value whether or not it is designated as currency.

The decision to designate gold as currency, or a standard for currency, is political.

Thus, gold is natural, and naturally useful, and may be designated as currency politically.

Cryptocurrency has no natural or intrinsic value, no use value.

Unlike the trade of gold, the trade of cryptocurrency depends on a belief that it is currency. Yet, it is not currency, because it has not been designated as currency politically. Once the realization is made that the necessary political process to designate it as currency will never occur, the will to trade is lost.